Cover your deposits with Nexus Mutual insurance alternatives

At Beefy, safety is our number one priority. That’s why we want you to have even more opportunities to reduce your risk when staking. Our new partnership with Nexus Mutual does just that. Cover your investments with the power of blockchain and rest easy knowing your funds are protected.

What is Nexus Mutual?

Nexus Mutual is an Ethereum-based insurance alternative that protects its users from a range of DeFi related losses. The project uses aligned incentives to enable risk-sharing among all its members and provides:

- Custody Cover to protect assets held on a centralized exchange

- Yield Token Cover that provides full-stack and de-peg protection

- Protocol Cover which provides cross-chain coverage. This includes protection against hacks, oracle failures, exploits, economic design failure, and governance attacks.

Ownership of Nexus Mutual’s token, NXM, is used to buy cover and navigate the claims and risk assessment process. Holders can also take part in governance too. Members of Nexus Mutual can:

- Become Risk and Claim Assessors

- Purchase cover

- Take part in governance

- Distribute risk through the mutual

How can I buy Nexus Mutual insurance for Beefy?

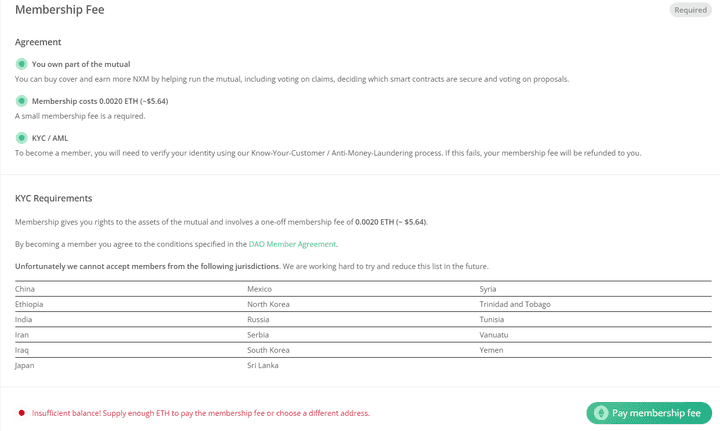

First, head to Nexus Mutual, connect your wallet and pay your membership fee to join the Mutual.

Next, head to the Buy cover page, search for Beefy and click [Get quote]. You’ll now be able to choose how long you want your cover for and how much you would like to cover. You can also select the crypto you’d like a payout in and see the required fee.

How much does it cost?

To cover your Beefy deposits, you’ll need to pay a 2.6% fee (assuming 50,000 staked NXM against Beefy risk) on your yield. However, you can also purchase wNXM at a discount by following Nexus Mutual’s guide. Your rate can also depend on the amount of capital staked, and fees are also payable in ETH, DAI, and NXM.

Why is the Nexus Mutual partnership good for Beefy?

Our partnership with Nexus Mutual opens the door to institutional investors that only want to invest in platforms that can be insured. With this partnership, new users have the best auto-compounding experience with ease of mind through Nexus.

Also, Beefy now has more than $1.1b TVL (Total Value Locked) compounding in our vaults. All of this capital can now enjoy the safety of Nexus Mutual Protocol Cover should a user wish.