Insights That Inspire: Introducing the Beefy Yield Module

I’m sure it’s happened to most of us before… you rush into a new opportunity for some incredible DeFi yields, only to find yourself struggling to keep track of things a few weeks later, and confused as to whether the promise ever materialized into reality. We all know that performance is never exactly as promised, but that’s easy to forget when promise is all you have to go on.

The problem here is that performance in DeFi is hard to measure, precisely because of just how flexible and composable the technology is. Consider for example the average Beefy vault, which relies on swapping between at least 3 separate underlying assets whilst each is constantly fluctuating in price, volume and liquidity against the others. Too often, users have settled for approximations and best guesses to measure their progress. We can and should expect more.

So the Beefy team has been back in the Data Barn, calibrating and testing their latest UI innovation, to deliver insights that inspire live and direct to your display. The hope is that, by providing you with a clearer picture of your real underlying performance, we can minimize reliance on trust and promises in the pursuit of their yield.

Yield Module

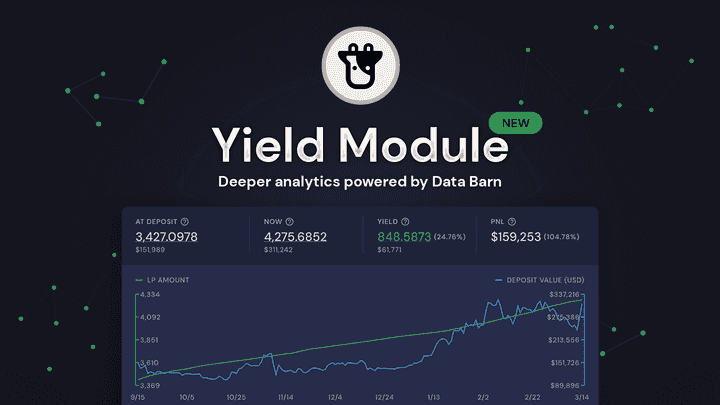

Introducing the Beefy Yield Module - our one-stop solution for measuring Beefy’s value creation. With the Yield Module, you can see a visualization of the quantity and market value of your position over time, measured in the underlying vault asset (e.g. the LP token). The Yield Module also gives you the 4 headline figures you’ll need to understand where your position is, where it’s come from, and how much you’ve earned from price appreciation and autocompounding.

At the center of the Yield Module is the distinction between prices and assets. Where DeFi markets can be extremely volatile, it’s easy to be dismayed by red candlesticks and to lose sight of real value. But your portfolio is more than just its market price, and with Beefy your underlying yield is always green. The Yield Module is a constant reminder of the power of autocompounding, which we hope will keep you focused on accumulation rather than appreciation.

Measures of Success

The Yield Module looks to 4 key metrics to measure your success:

The At Deposit figures show the net quantity and value of deposits in the vault’s base token (e.g. the LP token). For all deposits and withdrawals, the nominal number of base tokens are simply added or subtracted from the total. For the $USD value, deposits are measured at the market price of the base token at the time of deposit, so as to exclude any price appreciation. Withdrawals, on the other hand, are measured on a “first in first out” basis, so withdrawing the exact quantity of your earliest deposit will deduct the same $USD value that was recognised at the time of that deposit, even if you also made numerous subsequent deposits or earned substantial profits.

The Now figures show the comparable net quantity and value of base tokens measured right now. The $USD value reflects the current market price, so can be more or less than the At Deposit value. The Now quantity will always equal the At Deposit quantity plus the Yield quantity, meaning it is never less than the At Deposit quantity.

The Yield figures show the quantity and value of the yield generated by autocompounding in the Beefy vault. The quantity of Yield is the difference between the Now and At Deposit figures. The $USD value is the current market price for that precise quantity. There’s also a percentage, showing the quantity of Yield as a percentage of the At Deposit quantity.

The PNL figure shows the profit or loss in $USD on the position since launch, which is measured as the difference between the Now and At Deposit values. This includes the value of Yield, so does not reflect price appreciation alone. As with Yield, that’s also a percentage figure showing the quantity of PNL as a percentage of the At Deposit quantity.

Diving Deeper Into Data

By this point, you’ve probably realized that the Yield Module’s insights are pretty slick and cool ❄️. But as with any iceberg, the bulk of its mass sits well beneath the surface. The Yield Module is far from the culmination of our efforts… rather, it’s only the latest output of our longstanding mission to build extensive and performant data infrastructure, with the capability to deliver deep and powerful insights to every user with ease and simplicity.

To begin with, our project team - led by MrTitoune - set about indexing the broad array of blockchains Beefy has deployed on, allowing us to search, filter and isolate transactions across the masses of available data. As a result, we now have the capability to examine our choice of historic information across our variety of chains in new and exciting ways. We see this as opening the floodgates to an enormous splurge of possible analytics and data work.

On top of the indexing, we’ve also built extensive tooling to track and gather the underlying data we needed for the Yield Module, including historic prices, user-vault transactions, harvests and the price per full share of our mooTokens (among other things 👀). To quickly and efficiently serve this data to our applications and users, we also developed a selection of new APIs, with general purpose functionality for limitless possible use cases.

When you combine each of these different pieces together, you start to see that the new Yield Module is far more than just a fancy display or a one-off innovation. It represents our expanding framework for data analysis, which will power the next million Beefy vault harvests (and billions of percentage points of yield for our users). We’re calling this broader output our Data Barn - meaning the solid empirical foundation which will allow us to build increasingly sophisticated products and nuanced insights. With the innovations of our Data Barn on hand, it’s now time to revisit our user Dashboard, to see how we can deliver even more valuable portfolio analysis and help you implement the perfect investment strategies.

So what are you waiting for? Check out the Yield Module on the Beefy app now! And share your feedback with us on Discord and Twitter. We hope you enjoy it 📈