Pony Finance's new interest-bearing strategy gives Ethereum users access to Beefy's high yields and security for the first time.

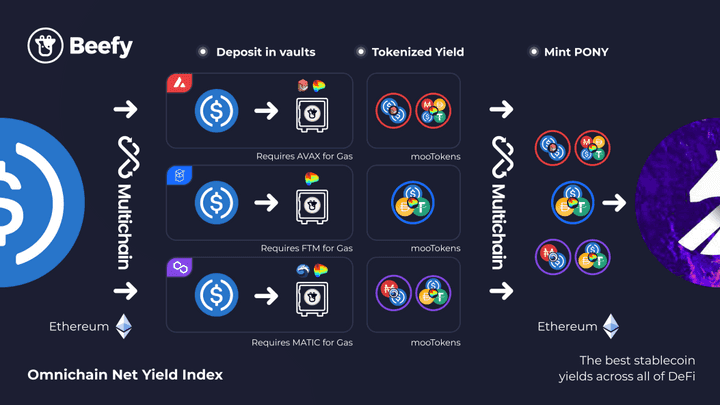

Tuesday, June 28, 2022 – In an industry first, Ethereum users can now gain exposure to Beefy Vaults through Pony Finance’s PONY (Passive Omni-chain Net Yield) Index. Holders of the ERC-20 token $PONY will be able to reap rewards from a basket of fully-collateralized stablecoins across multiple blockchains. Autocompunded interest generated by Beefy stablecoin strategies is then distributed back to $PONY holders staked in the $PONY rewards pool.

Curated by Beefy and enabled by Multichain

Scalara (a DeFi Pulse division) has created its index using Beefy’s Safety Score system. The basket consists of five stablecoin Vaults across Fantom, Avalanche, and Polygon selected for their stability and robustness against impermanent loss.

Users minting $PONY can deposit USDC into the $PONY minter smart contract and the funds are bridged via Multichain. The USDC is swapped for each specific token on their respective blockchains and deposited into the Vaults. Rewards are harvested and then bridged back to Ethereum and distributed to $PONY stakers.

“For too long, Ethereum users have been unable to quickly and efficiently gain exposure to a basket of Beefy stablecoin Vaults,” notes Weso, Beefy's Lead Developer and Strategic Partnership Coordinator.

“Our partnerships have allowed us to share the Beefy experience with a wider array of users and let them diversify their stablecoin investments over five fully-collateralized coins with ease.”

$PONY offers enhanced yields with managed risk

$PONY is a transparent product that can be easily vetted by any investor due to its on-chain nature. Its basket of fully-collateralized USD stablecoins has been selected so as to carefully manage the risk of impermanent loss and de-pegging.

A $PONY investor can check the composition of their investment and any subsequent rebalancings through a blockchain explorer. Investors can typically expect Yields within the range of 7-10% (subject to change) depending on the underlying Vault strategies.

Enhanced $PONY yields made possible by Beefy Vaults

$PONY relies on Beefy Vaults to earn optimized yields whilst maintaining the highest levels of security. In a Beefy Vault, investors earn more of their staked assets by automatically compounding gains.

Any associated costs are shared by Vault investors, significantly lowering the fees and time needed in comparison to manually reinvesting. With Beefy, you can earn maximized yields on a variety of trusted platforms including Curve, Trader Joe, and QuickSwap among others.

—-—-

About Beefy

Beefy is a Decentralized, Multi-Chain Yield Optimizer platform that allows its users to earn compound interest on their crypto holdings.

Through a set of investment strategies secured and enforced by smart contracts, Beefy automatically maximizes the user rewards from various liquidity pools (LPs), automated market making (AMM) projects, and other yield farming opportunities in the DeFi ecosystem.

The main product offered by Beefy is its 'Vaults' in which you stake your crypto tokens. The investment strategy tied to the specific vault will automatically increase your deposited token amount by compounding arbitrary yield farm reward tokens back into your initially deposited asset. Despite what the name 'Vault' suggests, your funds are never locked in any vault on Beefy: you can always withdraw at any moment in time.

DApp | Docs | Twitter | Discord | Reddit | YouTube | Telegram | GitHub