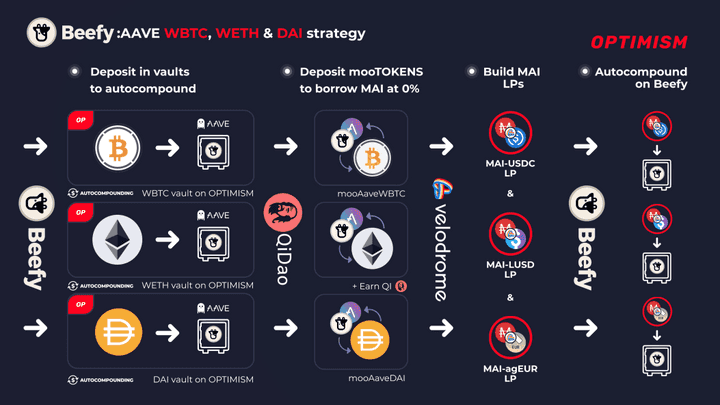

Welcome to the Beefy x QiDao x Velodrome strategy

For holders of DAI, WETH, and WBTC on Optimism, Beefy’s new earning strategy offers a new way to earn native rewards of your deposited token. By using QiDao protocol’s collateralized loans system and Velodrome’s incentivized liquidity pools, you can start earning highly-optimized WBTC, WETH, and DAI rewards with just one Vault.

What is QiDao?

QiDao lets you hold onto your crypto while also allowing you to spend its extracted value. By staking your crypto, you can borrow the MAI stablecoin at 0% interest, with each token pegged to the dollar. Your crypto simply acts as the collateral.

To mint MAI, users deposit their tokens into a specific MAI vault for their cryptocurrency on the Polygon, Fantom, Solana, or Avalanche networks. MAI is overcollateralized, meaning that you will only receive stablecoins at around two-thirds of the value of your crypto deposit.

What is Velodrome?

Velodrome is an AMM on Optimism designed to provide deep liquidity and low fee/slippage trades. The protocol is an improved fork of the Solidly Exchange launched by Yearn founder Andre Cronje and has seen a large following and volume staked since its launch.

What is a mooToken?

If you interacted with Beefy before, you would have noticed that after you deposited in any Beefy vault, you received in exchange a new token with the prefix “moo” that represents your share in the vault.

For example, if you deposit BNB into the BNB Vault, you’ll receive mooBNB tokens that represent your share of the vault. The amount won’t match 1:1, but you’ll always get back your original deposit plus any interest earned.

Beefy always recommends not selling your mooTokens on unsupported platforms, because most of the time this will result in a loss of funds. However lately more and more Dapps are giving utility to mooTokens and the ability to use them as collateral or leverage. This means that you can deposit your mooTokens in other projects like QiDao.

How does the strategy work?

- To begin, users deposit WBTC, WETH, or DAI into one of Beefy’s Aave Vaults on Optimism. This provides the user with mooTokens.

- The mooTokens are then leveraged using QiDAO to take out MAI loans with 0% interest (and also providing QI earnings when leveraging WETH).

- MAI is deposited on Velodrome in USDC, LUSD, and agEUR liquidity pools.

- These LP tokens are then autocompounded in Beefy Vaults.

- The total rewards are then converted back into the originally deposited asset (WBTC, WETH, or DAI).

Note that the initial debt ceilings for the MAI vaults are set at:

- WBTC- 100,001

- WETH- 100,001

- DAI - 50,001